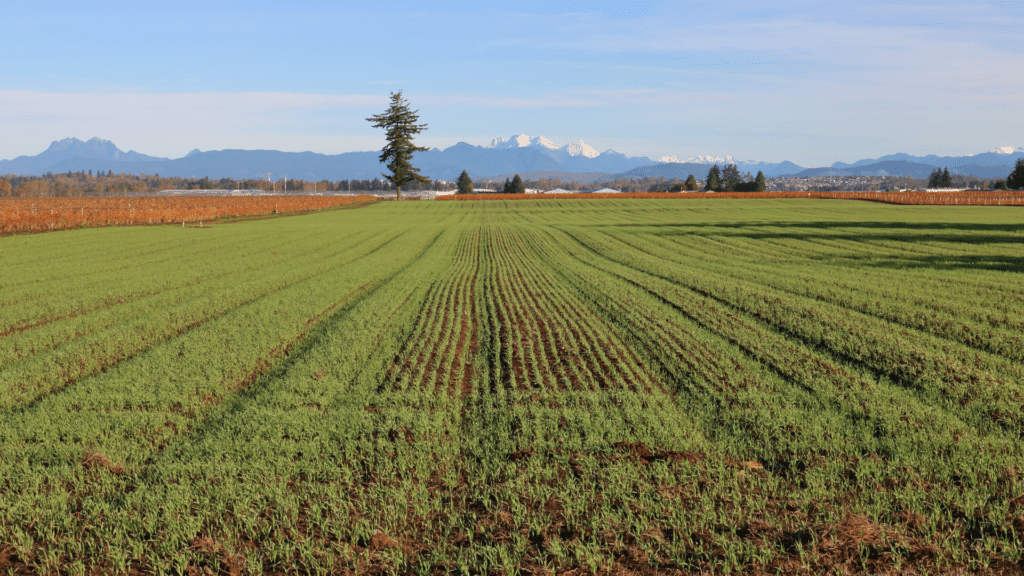

Agricultural and Rural

Selling Agricultural Land for Development: Essential Factors to Consider

Farmland is highly valuable to agricultural businesses, but many people are selling their land for development purposes. To sell agricultural land successfully, it’s crucial to understand the process, which is where external help can be valuable. Before selling land for development, it is crucial to consider whether or not the land is suitable, especially in…

Read MoreMinimising Inheritance Tax on Farms: The Benefits of Agricultural Relief

Agricultural Relief (AR) helps farmers reduce their potential Inheritance Tax (IHT) liabilities and secure their assets for future generations. Inheritance tax on farms is due when asset value exceeds the standard IHT threshold upon the owner’s death. This threshold is £325,000 and applying the standard IHT rate of 40% would result in a substantial liability.…

Read MoreUpdate to Planning Laws for Agriculture: Farmers Gain Flexibility to Repurpose Buildings

Farmers may benefit from extended planning regulations which came into effect in May 2024. The UK government’s recent consultation updating Class Q and Class R Permitted Development Rights, has paved the way for agricultural diversification, allowing farmers flexibility to repurpose agricultural buildings. The updated rules permit farmers to convert existing agricultural structures into residential properties,…

Read MoreSafeguarding Your Farming Estate: Estate Planning Tips for Farmers

Estate planning for farmers is a crucial step in safeguarding the future of your family home and business. This not only involves preparing for a smooth transition into retirement but also ensuring the continuity of your farming operations for years to come. To create a comprehensive estate plan, it is essential to consider factors such…

Read More