Minimising Inheritance Tax on Farms: The Benefits of Agricultural Relief

Agricultural Relief (AR) helps farmers reduce their potential Inheritance Tax (IHT) liabilities and secure their assets for future generations.

Inheritance tax on farms is due when asset value exceeds the standard IHT threshold upon the owner’s death. This threshold is £325,000 and applying the standard IHT rate of 40% would result in a substantial liability. However, agricultural property reliefs such as Agricultural Relief (AR) and Business Relief (BR) can significantly diminish the IHT on farms.

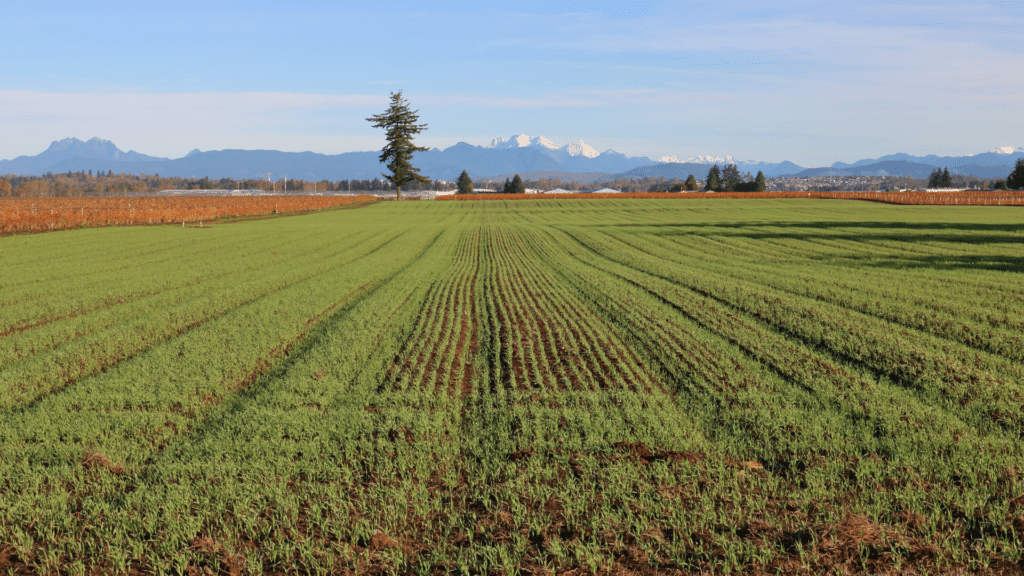

Agricultural Relief is a tax relief for farmers to minimise inheritance tax on agricultural land and buildings used for farming. The aim is to enable owners of agricultural properties to pass them on without facing an unmanageable tax burden, and to avoid forced sales due to high tax liabilities of inheritance tax on farmland. The relief is only applicable against the agricultural value of land being used for farming, which is usually much less than the market value of all available land. It is important to seek guidance from a legal specialist when considering estate planning.

To qualify for Agricultural Relief, the farm must have been occupied and used for farming purposes for the past two years by the person transferring their estate or owned by the person transferring their estate for the past seven years while being used for farming. The full AR rate of 100% is widely used, but a reduced rate of 50% may apply in certain circumstances where the property does not meet all the conditions required. These include diversification of land use, farmhouses not used for agricultural purposes or not occupied by the farmer, conservation purposes, and unused land. It is best to seek the guidance of a law firm specialising in agriculture to navigate inheritance tax on farmland.

Business Relief is an alternative to Agricultural Relief and can reduce the taxable value of business-related assets for tax purposes when passing them on through inheritance, depending on whether shares in the business are being sold or certain assets like land, buildings, or machinery. The business must have been owned by the person transferring the estate for the past two years to qualify for Business Relief.

Thursfields is experienced in navigating complex Agricultural Relief regulations and offers comprehensive guidance on inheritance tax on farms. We offer in-house solutions for family law, employment law, commercial business, and more. Thursfields is committed to securing your family’s future and providing tailored legal solutions for farmers and landowners. Call us today on 0345 20 73 72 8 for a personalised service or find out more by visiting: Agricultural Solicitors | Agricultural Law | Thursfields Law Firm.